All Categories

Featured

Table of Contents

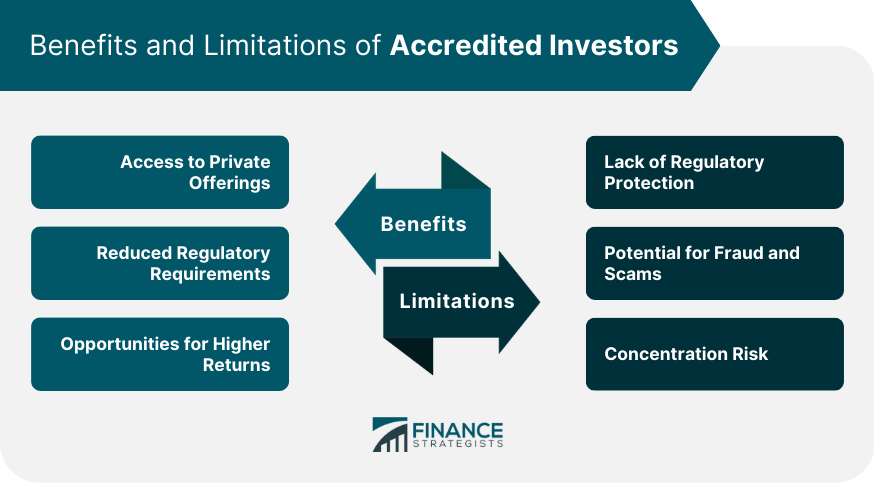

Investments include risk; Equitybee Securities, member FINRA Accredited investors are one of the most competent financiers in the company. To certify, you'll require to meet one or more demands in revenue, total assets, asset dimension, administration standing, or expert experience. As an approved capitalist, you have accessibility to more complex and advanced kinds of protections.

Enjoy access to these alternate financial investment chances as an approved investor. Continue reading. Certified financiers usually have a revenue of over $200,000 separately or $300,000 jointly with a partner in each of the last two years. AssetsPrivate CreditMinimum InvestmentAs low as $500Target Holding PeriodAs short as 1 month Percent is a personal credit rating financial investment platform.

Turnkey Real Estate Investments For Accredited Investors for Accredited Investor Deals

To gain, you simply need to register, buy a note offering, and await its maturity. It's a great source of passive revenue as you do not require to monitor it very closely and it has a short holding duration. Excellent annual returns range in between 15% and 24% for this property course.

Possible for high returnsShort holding duration Resources in jeopardy if the debtor defaults AssetsContemporary ArtMinimum Financial investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes excellent artworks for investments. It acquires an artwork via public auction, then it registers that asset as an LLC. Starting at $15,000, you can purchase this low-risk property class.

Buy when it's supplied, and afterwards you get pro-rated gains as soon as Masterworks sells the art work. Although the target period is 3-10 years, when the artwork reaches the wanted value, it can be offered previously. On its site, the most effective admiration of an artwork was a massive 788.9%, and it was just held for 29 days.

Its minimum starts at $10,000. Yieldstreet has the widest offering across alternative investment systems, so the quantity you can make and its holding period differ. There are products that you can hold for as short as 3 months and as long as 5 years. Generally, you can gain with dividends and share admiration gradually.

Premium Private Placements For Accredited Investors for Wealth-Building Solutions

One of the drawbacks right here is the lower annual return price compared to specialized systems. Its management fee typically varies from 1% - 4% annually. private equity for accredited investors.

In enhancement, it gets rent income from the farmers throughout the holding duration. As a financier, you can make in two ways: Get rewards or money return every December from the rent paid by lessee farmers.

Dependable Passive Income For Accredited Investors for Accredited Investor Wealth Building

If a residential property gains enough value, it can be marketed previously. One of its offerings was shut in just 1.4 years with a 15.5% realized gain. Farmland as an asset has historically reduced volatility, that makes this a wonderful alternative for risk-averse financiers. That being claimed, all investments still bring a particular level of risk.

In addition, there's a 5% charge upon the sale of the entire property. Steady possession Annual cash yield AssetsCommercial Real EstateMinimum InvestmentMarketplace/C-REIT: $25,000; Thematic Finances: $100,000+Target Holding PeriodVaries; 3 - one decade CrowdStreet is a commercial property financial investment platform. It purchases numerous deals such as multifamily, self-storage, and commercial residential properties.

Handled fund by CrowdStreet Advisors, which immediately diversifies your investment across various residential or commercial properties. Accredited Investor Opportunities. When you spend in a CrowdStreet offering, you can obtain both a cash return and pro-rated gains at the end of the holding duration. The minimal investment can differ, however it generally starts at $25,000 for marketplace offerings and C-REIT

While some properties may return 88% in 0 (private placements for accredited investors).6 years, some assets lose their value 100%. In the history of CrowdStreet, more than 10 residential or commercial properties have adverse 100% returns.

Next-Level Accredited Investor Platforms

While you won't get ownership below, you can potentially obtain a share of the profit once the startup efficiently does a departure occasion, like an IPO or M&A. Several good companies continue to be private and, consequently, typically unattainable to financiers. At Equitybee, you can fund the stock choices of staff members at Red stripe, Reddit, and Starlink.

The minimum investment is $10,000. This platform can potentially provide you large returns, you can additionally shed your entire cash if the start-up falls short.

So when it's time to exercise the alternative during an IPO or M&A, they can benefit from the possible increase of the share price by having an agreement that enables them to get it at a price cut. Accessibility Hundreds of Start-ups at Past Valuations Expand Your Profile with High Growth Startups Spend in a Formerly Hard To Reach Possession Course Subject to accessibility

It can either be 3, 6, or 9 months long and has a set APY of 6% to 7.4%. Historically, this revenue fund has exceeded the Yieldstreet Alternative Revenue Fund (previously understood as Yieldstreet Prism Fund) and PIMCO Income Fund.

Accredited Investor Investment Opportunities

Other functions you can spend in include buying and holding shares of industrial spaces such as commercial and multifamily homes. Some customers have actually complained regarding their absence of transparency. Evidently, EquityMultiple does not interact losses immediately. Plus, they no longer release the historical efficiency of each fund. Temporary note with high returns Lack of openness Facility costs structure You can certify as a certified financier using 2 requirements: monetary and specialist abilities.

There's no "examination" that provides an accreditor investor license. One of one of the most essential points for an accredited capitalist is to protect their funding and grow it at the very same time, so we chose assets that can match such different danger cravings. Modern investing systems, particularly those that provide alternate properties, can be quite uncertain.

To ensure that accredited capitalists will certainly be able to develop a detailed and varied profile, we picked platforms that can satisfy each liquidity demand from short-term to lasting holdings. There are various investment possibilities certified capitalists can explore. But some are riskier than others, and it would certainly depend on your risk cravings whether you 'd go all out or not.

Recognized capitalists can diversify their investment portfolios by accessing a wider series of possession courses and financial investment approaches. This diversity can aid minimize danger and improve their overall portfolio efficiency (by preventing a high drawdown percentage) by lowering the dependancy on any type of solitary financial investment or market industry. Certified investors commonly have the possibility to connect and team up with other similar capitalists, sector professionals, and business owners.

Table of Contents

Latest Posts

Tax Lien Investing Texas

Tax Lien Houses

List Of Tax Lien Properties

More

Latest Posts

Tax Lien Investing Texas

Tax Lien Houses

List Of Tax Lien Properties